Not known Details About Vancouver Tax Accounting Company

Wiki Article

See This Report about Tax Accountant In Vancouver, Bc

Table of ContentsThe smart Trick of Vancouver Accounting Firm That Nobody is Talking AboutWhat Does Vancouver Accounting Firm Mean?The Only Guide for Tax Accountant In Vancouver, BcTax Consultant Vancouver Fundamentals Explained

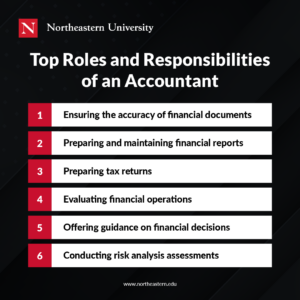

Not only will keeping neat files as well as records assist you do your job more effectively as well as properly, however it will certainly also send a message to your employer and also customers that they can trust you to capably handle their economic information with respect and also integrity. Understanding the many projects you have on your plate, knowing the target date for each and every, and also prioritizing your time as necessary will make you an incredible asset to your employer.

Whether you keep an in-depth calendar, established normal pointers on your phone, or have a daily order of business, remain in charge of your timetable. Remember to stay adaptable, however, for those urgent demands that are tossed your method. Merely reconfigure your top priorities so you remain on track. Also if you favor to hide with the numbers, there's no obtaining around the fact that you will be called for to communicate in a range of ways with coworkers, supervisors, clients, and also market specialists.

Also sending out well-crafted e-mails is a vital ability. If this is not your strength, it might be well worth your time and also effort to get some training to raise your value to a prospective company. The accounting area is one that experiences routine adjustment, whether it be in regulations, tax codes, software program, or best methods.

You'll discover important assuming abilities to aid determine the long-lasting goals of a business (and also create strategies to achieve them). Check out on to uncover what you'll be able do with an accountancy degree.

Pivot Advantage Accounting And Advisory Inc. In Vancouver for Dummies

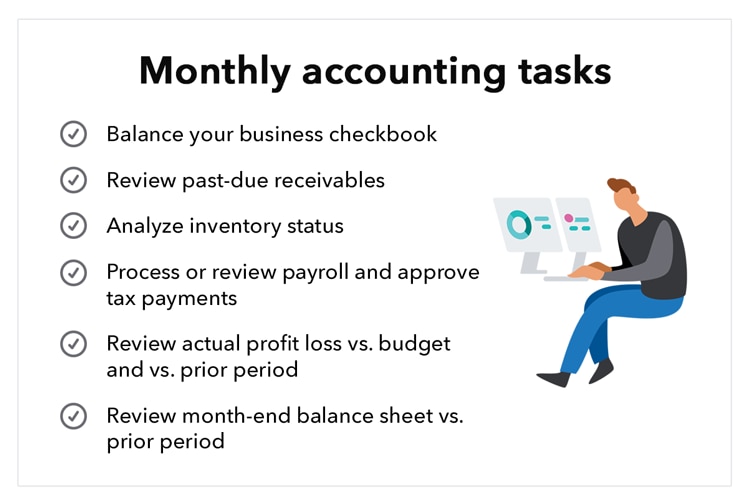

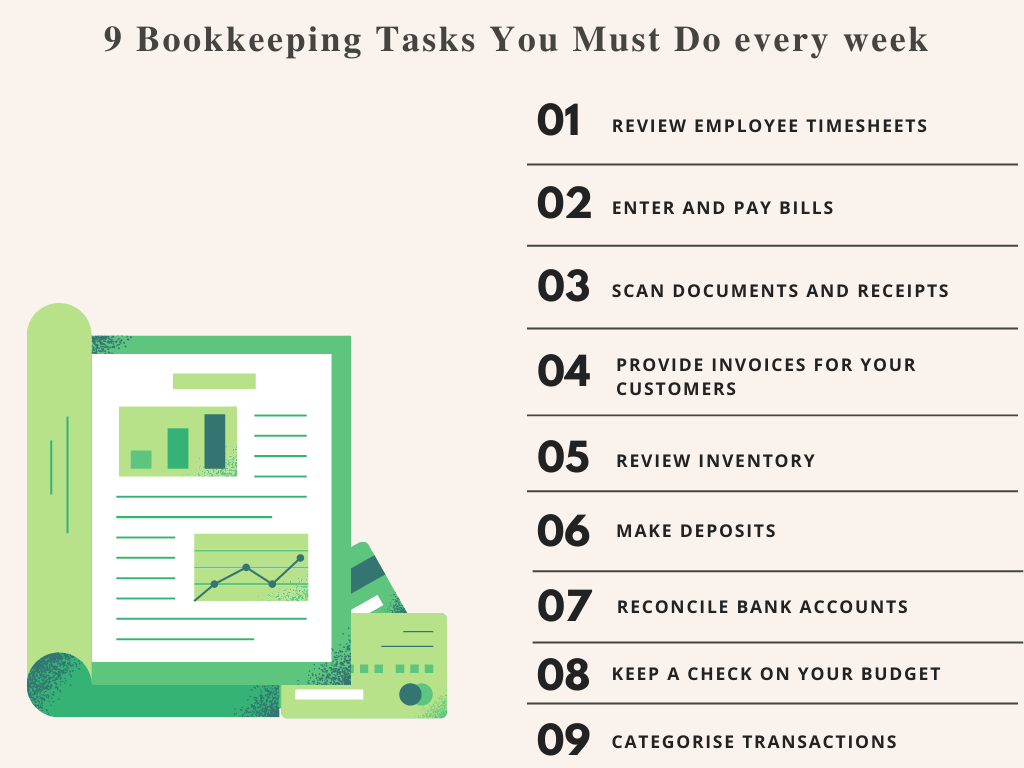

Just how much do accountants as well as accountants charge for their solutions? As typical, the response is it depends, but this write-up will supply details on the traditional per hour billing approach along with how we price our solutions below at Avalon. Just how a lot do bookkeepers and accountants bill for their services? As typical, the answer is it depends, however this short article will give details on the traditional hourly payment approach as well as how we price our services right here at Avalon.To comprehend rates, it's handy to know the distinction in between bookkeeping and also audit. These two terms are typically utilized mutually, however there is a substantial distinction between bookkeeping as well as accountancy services. We have created in detail around, but the really standard feature of an accountant is to videotape the transactions of an organization in a regular way.

Under the typical approach, you won't know the quantity of your costs till the work is complete and also the provider has actually included up all of the minutes spent dealing with your data. Although this is a typical pricing technique, we locate a number of points wrong with it: - It produces a scenario where clients really feel that they should not ask concerns or gain from their accountants as well as accountants due to the fact that they will certainly be on the clock as soon as the phone is addressed.

All About Small Business Accountant Vancouver

If you're not satisfied after finishing the course, simply get to out and also we'll offer a complete reimbursement with no questions asked. Currently that we have actually discussed why we do not like the conventional design, allow's look at just how we price our services at Avalon.

we can be available to aid with accounting and accountancy questions throughout the year. - we prepare your year-end financial statements and tax obligation return (outsourced CFO services). - we're right here basics to assist with concerns and guidance as needed Systems arrangement as well as individually accounting training - Annual year-end tax filings - Advice with questions as required - We see a great deal of tiny organizations that have yearly profits between $200k and also $350k, that have 1 or 2 employees as well as are owner managed.

Strong visit regular monthly reporting that consists of understanding from an outside consultant is a key success variable here. - we established up your cloud bookkeeping system and also show you exactly how to submit files online and view reports. - we cover the expense of the accounting software program. - we videotape month-to-month purchases and send out beneficial financial records once each month.

How Small Business Accountant Vancouver can Save You Time, Stress, and Money.

We're also readily available to answer concerns as they come up. $1,500 for bookkeeping and also payroll systems configuration (single expense)From $800 monthly (includes software application fees as well as year-end expenses billed monthly) As services expand, there is commonly an in-between size where they are not yet big sufficient to have their own inner money department yet are complicated sufficient that simply working with a bookkeeper on Craigslist will not reduce it.Report this wiki page